Learn how to craft a tax newsletter for clients in order to strengthen your key relationships and pivot your practice from compliance to advisory.

Today we want to talk about an easy method for growing your practice: staying in contact via e-newsletters. This is a great way to add value for your clients and enhance your practice. To illustrate, we’ll use the example of a tax newsletter for clients.

Step 1: Choose Your Audience

We touched on this step in a previous post about creating an effective CPA newsletter. There, we discussed why and how to segment your contacts by interests. The gist of it was that it’s very difficult to craft an e-newsletter that will be relevant to all of your contacts at once. Rather than attempting this, break your important contacts down into different groups by interest. After doing so, craft separate newsletters for each group.

So, in keeping with our example of a tax newsletter for clients, here’s what we recommend. Choose a subset of clients in the same field who deal with similar tax issues, and create an e-newsletter that they will all find relevant.

Step 2: Article Summary

Sharing relevant information with your clients is a fantastic way to add value for them without requiring a big investment of time on your end. Once you’ve decided which segment of contacts you’d like to reach out to, find an article that is relevant to the group. You’ll want to write up a quick executive summary to include in your e-newsletter—something that highlights key items of importance to the newsletter recipients.

With all of the tax law developments that have occurred over the last year-and-a-half, it’s not hard to find articles applicable to clients in a variety of areas. Here are some examples of articles to share in your tax newsletter for clients:

- For small business clients, consider informing them about pending tax legislation that could impact them;

- For clients in the construction industry, try an article on the new Opportunity Zones program created by the Tax Cuts and Jobs Act (TCJA);

- Perhaps this article on how the TCJA will impact retirees might be apt for your more mature clients.

Step 3: Email Frame

The next step is to craft an email frame that fits both the article you chose and the audience to whom you’re sending it. It should feel personal and pointed, but also be generic enough that you don’t have to modify it for each individual contact (beyond addressing it to the correct name).

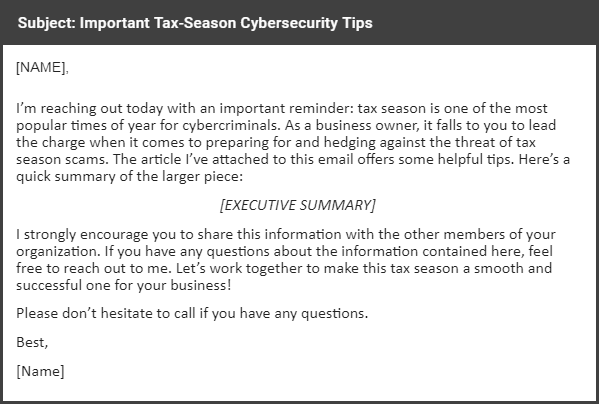

Here’s an example of what we’re talking about:

Simply craft your email frame, insert the quick article summary you developed, and don’t forget to include a link!

Step 4: Send it out

The last step is to distribute your tax newsletter to the right contacts. Depending on what sort of tools you have access to, this might even be the most time-consuming step! If you’re doing it manually via your email account, make sure that you double (or even triple) check to make sure that you’re using the correct first name and email address pairings.

CRM Tools to Facilitate Your Tax Newsletter for Clients

If you’re lucky, you have access to a tool with email automation capabilities—this makes distributing your emails (and making sure they addressed to the correct client) a snap. For example, ABLE, the CRM for CPAs, offers a Thought Leadership tool that makes sending one-to-many emails in a one-to-one format quick and easy. Want to learn more? Check out this article on how ABLE helps its users become thought leaders.

Ready to give a CRM for accountants a try? Click here to schedule a free, no-obligations demo and learn how ABLE can help you add value and elevate your practice today.