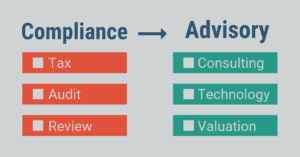

Compliance vs. Advisory services

We like to think about compliance and advisory services like this: Compliance is a need to have, advisory is a want to have. Compliance services consist of things like taxes and audits, where advisory services deal with consulting and wealth management.

Why switching is important

Offering more advisory services at your firm will improve many aspects of your business. The COVID-19 pandemic has propelled this shift in the accounting profession, allowing more firms to start the process and offer more consulting services. Adding these services can help reduce seasonality and spread out the amount of work throughout the year.

You are also adding value to your business when offering more advisory services. Think of it as your obligation to your client. You want to give your clients the best experience, and if you don’t offer these services, another firm will. Getting into a compliance to advisory mindset will produce more well-rounded advisors and better ROI.

What can you do to prepare?

- Expand your firm’s core services and practice cross-selling – What can your firm offer to provide more advisory services?

- Change your mindset about sales – Think more of a consultant than a car salesman

- Reach out to current clients and see if they know about all of the services your firm offers – A quick 10 minute call can go a long way

How ABLE can help

Another important aspect of being a trusted advisor is also being a thought leader. Becoming an expert in your client’s field will go a long way. With ABLE’s thought leadership tools, you can send industry specific content to multiple contacts with just a few clicks of your mouse.

There are many benefits to implementing a CRM, especially while switching from compliance to advisory services. Ready to learn more? Schedule a free, no-obligations ABLE demo today to talk with an ABLE expert about how our system can help you elevate your firm.