Does your firm have a plan in place for making the compliance to advisory shift?

Compliance to Advisory Q&A with Charles Hylan

Need some advice from an expert? Check out this interview with ABLE’s own Charles Hylan. In this video, Charles gives a quick overview of his professional background, then dives into the key components of making the compliance to advisory shift. Check it out below, or continue scrolling for a full transcript of the interview:

What is your professional background?

I started as an auditor with Arthur Andersen. After about three years doing that, I transitioned into a marketing and consulting role, where I spent another four years. After that, I joined The Growth Partnership, which is a consulting firm for the accounting profession.

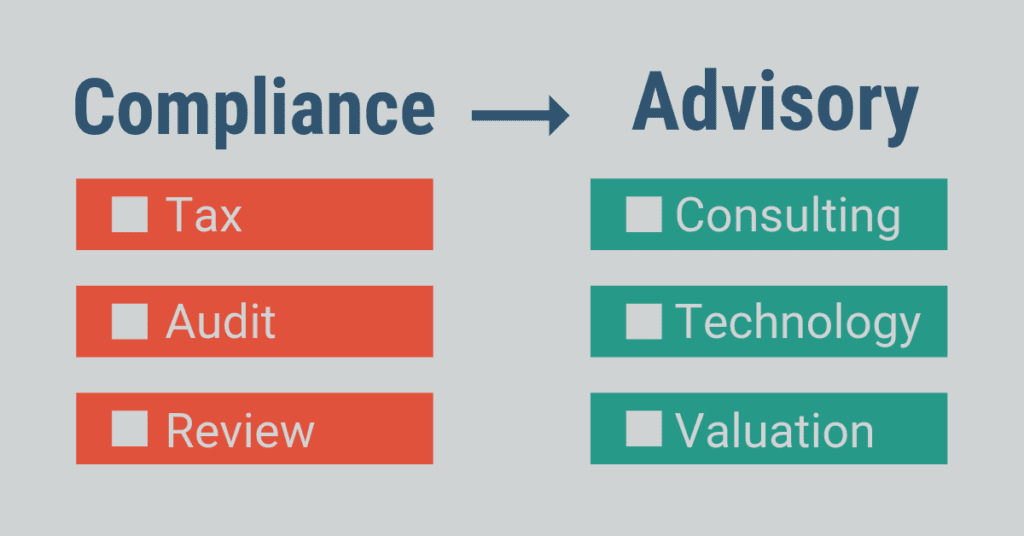

What does it mean to make the compliance to advisory shift?

At a basic level, it is a firm shifting their mix of services from compliance—think of tax, audit, reviews, compilations, things of that nature—to advisory. Those being services such as consulting, wealth management, technology, business valuations, and more.

Why is this shift important to accounting firms?

This shift is important because technology is really changing what an accounting firm does and, more importantly, what clients want from an accounting firm. The fees for compliance-related services are really being driven down, and clients are seeking firms that offer more advisory-level work.

How can ABLE help a firm make this transition successfully?

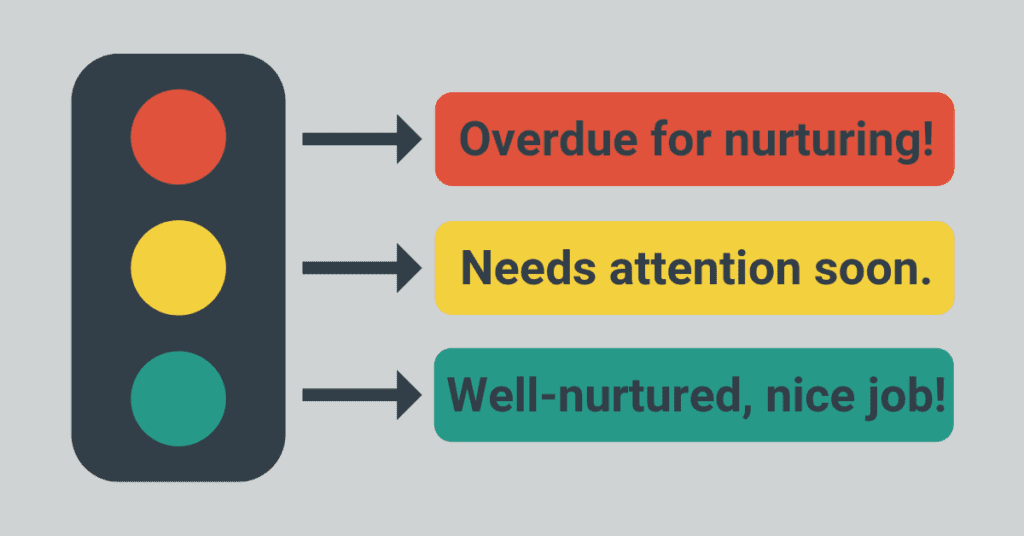

1. Relationship Management

The foundation of any advisory relationship is just that—a relationship. One thing that ABLE does a really good job of is helping you position your top 36 relationships in front of you and give them real focus. ABLE categorizes your relationships as either red, yellow, or green. Red: You’re not doing what you need to be doing to nurture those relationships. Yellow: This relationship is about to be red, it will need attention soon. Green: You are nurturing these relationships the way they want to be nurtured.

2. Thought Leadership

Additionally, as an advisor, you need to be a thought leader. ABLE has some functionality that allows you to be a thought leader within your constituents. So think of an industry, think of manufacturing, or auto dealers, etc. ABLE offers tools for easily sharing pertinent information with your various contacts.

3. Pipeline Management

And then lastly, as we make the compliance to advisory shift, the need to grow is key. ABLE has a pipeline feature that allows you and your fellow partners and managers to really manage that pipeline of growth opportunities.

Learn More About How ABLE Can Help

The benefits of employing a CRM for CPAs are many. In the particular area of transitioning from compliance to advisory service offerings, ABLE’s key offerings are its tools for relationship development, pipeline management, team accountability, and thought leadership. These are all important areas of focus for firms looking to make their compliance to advisory shift smooth and seamless.

Ready to learn more? Schedule a free, no-obligations ABLE demo today to talk with an ABLE expert about how our system can help you elevate your firm.